The debate these days among the econ-con pundicrats

might be personified as a proxy-by-posse duel betwixt two demigods of the 1920's and 30's, Irving Fisher --

vs J.M. Keynes --

-- a duel in the sun between the patron saint of direct and borrowed gubmint expenditures,

and the wizard of Flatlandian monetary magic.

We all know about Keynes and his liquidity trap, right?

Well, be prepared now to meet and greet doctor

Irving Fisher, eugenicist, preacher's boy,

and diet nut, father of a self-reported

"both new and important" deflation debt

dive bomb theory of depressions.

Two sides of the same coin? Are they both

about the flaw at the core of a private

credit based economy?

Not exactly -- there's enough difference between

'em to muster loudly opposing factions

for today's great policy moment:

Uncle as direct buyer of first resort

for lots of real neat green stuff,

vs. Uncle as buyer of last resort for all

things figmentary and toxic.

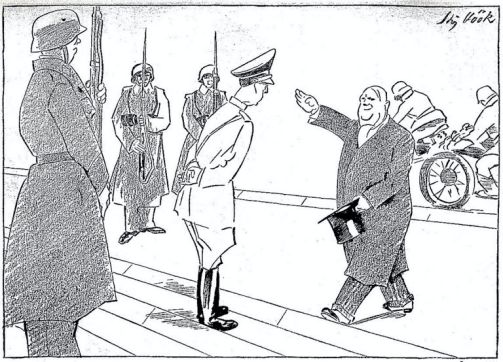

Put that way, it sounds obvious who's the

heel and who's the babyface. But not so fast,

comrades.

Both men's models were designed in, by, and

for the great depression.

But by the time the war to end depression

had subsided into a cold peace,

Keynes and his "theory" were king of the planet,

whereas Fisher, though home-grown and,

in the roaring 20's, every bit as much of a

superstar as Keynes

(and a pro-business, anti-labor superstar

to boot) found his rival paradigm largely

unattended-to, not only in academia, but in

leading American policy circles as well.

Up and down the line, it was Keynes' century,

and so it remained, all through the Harry, Ike

and Jack years. In fact, the triumph of Keynes

and his postwar Hicksite followers

was so complete by the time of LBJ and RMN --

in other words by amok time -- that

even the Chamber of Commerce had its version --

though de-balled -- of Keynes.

"We're all Keynesians now," dear old Dick once

glowered to the press.

By the high 60's, fiscal deficits

had become the universal Rx for the

system's mild macro slumps.

Credit policy was left to the pinch-nosed,

green-eyeshade guys, while the likes of Paul

Samuelson and Jim Tobin

carefully calibrated the nation's optimal federal

deficits.

But Fisherian deflation theory, with its starring

role played by the monetary authority,

arrived or re-arrived back on the scene --

albeit as a late entrant after the kook-krieg of

flame fanners and zoo-doers --

and Irv was a major beneficiary of the highly

successful anti-Keynesian, anti-fiscalist

campaign touched off by the deadly bottom-line

events of the late 70's. Stagflation!

The Waterloo for Keynes and his borrow-to-spend

formula. And particularly during the Reagan salad

days, a new macro mindset triumphed -- despite

the evidence at hand, i.e. the economy roaring

out of the 82-83 contraction, prolly more from a

Keynesian huge deficit run and military buildup

than through Kodiak Volcker's final removal of

the figure-four credit lock he'd applied back

in '79. But that's another story.

In retrospect, it would seem that the

immiserating events of the failed Carter

crusade had told an eternal truth:

larger fiscal deficits as attempts

to tune up job markets ultimately lead to

uncontrollable wage-price cyclones.

Cyclones like the ones that blew apart

the late 70's also blew apart the city

of light that Johnny K's acolytes were

attempting to build in postwar America.

The day of the money-base loons had

arrived, and with them came the retreat

of the Keynesians into post-Keynesians.

Like monks in Ireland, they kept the

candles of truth burning -- ahh,

maybe with a bit of twist to 'em,

I must admit.

The new respectable macro science found Fisher.

So what was Fisher's angle? His starchy Yankee

values were repelled by handouts and confiscatory

transfers, and building public pyramids in the

wilderness, so he looks on first view like a nice

antidote to the flippant gay British free-lunch

advocate.

In the dark days of the depression,

doctor Fisher, looking out his Yale office

window at a misery visible, like any good

scientist, tried to find a way to reconcile

his deepest disciplinary prejudices with what

he observed around him.

The unorthodox virulence of the great contraction

had shattered his boundless high spirits.

After some false starts and fad fancies,

our man, in a moment of clarity, built a simple

model of explanation that -- worked.

He kept his model of the "real economy",

the market-based production system, intact,

but he constructed a new addition to his overlying credit system.

Short course:

Left to the whims and vaguaries of the unfettered

market systems, both credit and production,

any rapid accumulation of excess unsustainable

private debt will lead inevitably to a period of

"realization" and subsequent panic and crisis.

And that leads on to massive asset liquidation,

and from there we go into a protracted grinding

deflation, a downward spiral where our already

burdensome debt loads become ever heavier as prices

and incomes and outputs fall,

and consquently defaults grow ever bigger and spread

ever wider.

Okay. So that's kinda kool. On rediscovery, who do

you think became the number-one fans of this Fisher

deflation model?

Ten years ago, that would be hard to pick. You

got folks all the way from Krugman on the white-hat

side, to Taylor on the black to pick from.

But now, after all the swanning-about of the hi-fi

credit system these last dozen years or so,

paleo-Keynesians have sallied from the Ivy

towers to do battle with the monetary macro-uber-alles

crowd -- often, as in Krug's case, the paleos are

reborn post-Keynesians. And all this, of course,

gets muddled by the multitude of shallow syncretists

attempting to blend the two sharply opposed equestrian

schools into a common camel jaunt.

At one pole you got yer Fisherian policy camp calling

for maximum balance sheet actions,

versus those dauntless paleo-Keynesians

calling for maximum infrastructure-building, benefit-extending,

state-budget-boosting by means of federal budget busting, etc.

The credit economy vs. the production economy?

Bankers vs hard hats?

Ah, if it were such a simple choice:

Scrooge or the union kulaks --

who would not know which side to be on?

But my friends, both sides dance inside the

circle of doom.

Stay tuned.

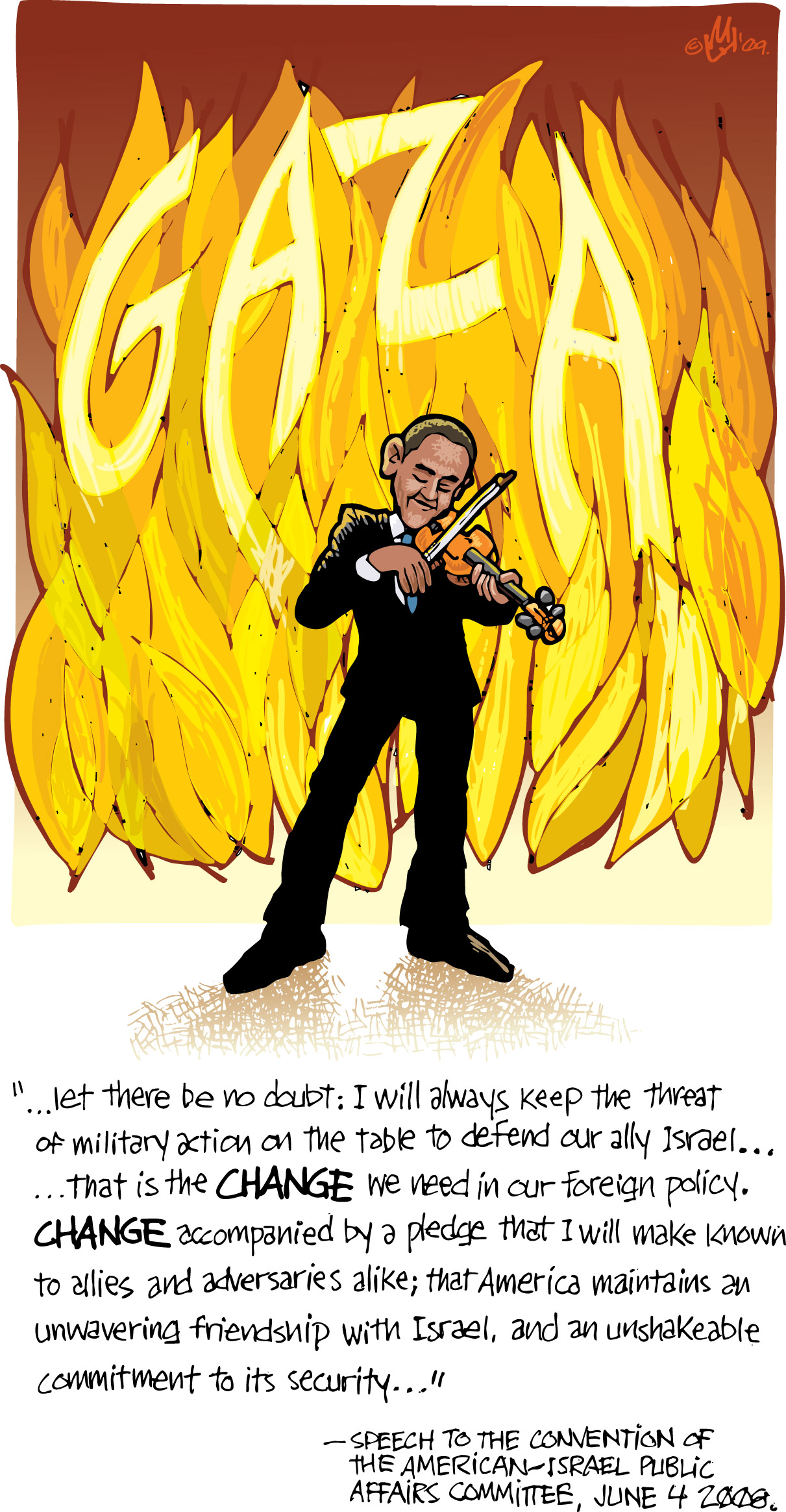

Lets call it the Dumbbell Axis -- the Jewish State as one bell and "Hindia" as the other.

In the ongoing struggle to make the whole planet safe for limited liability corporate settlement, these two are Big Sam's best sidekicks.

Lets call it the Dumbbell Axis -- the Jewish State as one bell and "Hindia" as the other.

In the ongoing struggle to make the whole planet safe for limited liability corporate settlement, these two are Big Sam's best sidekicks.