Here's Paul Krugman explaining a mystical concept, "core inflation":

"Some prices in the economy fluctuate all the time in the face of supply and demand; food and fuel are the obvious examples. Many prices, however, don’t fluctuate this way — they’re set by oligopolistic firms, or negotiated in long-term contracts, so they’re only revised at intervals ranging from months to years....I hasten to note that the dismal science, as practiced by our leading neoliberals, has no "real" price setting model -- just this smudgery, this metaphorical pataphysical mush.[B]ecause they aren’t revised very often, they’re set with future inflation in mind...

[W]e’d like to keep track of this sort of inflation inertia, both on the upside and on the downside — because just as embedded inflation is hard to get rid of, so is embedded deflation (ask the Japanese)."

"[O]nce expectations of, say, persistent 10 percent inflation have become “embedded” in the economy, it will take a major period of slack — years of high unemployment — to get that rate down.""Oh the pain, the pain!" as a great space coward, shown up top, was wont to cry.

Fortunately, we don't need a model of how the system works, nor even face the pain of adjustment -- not if we sieze power and superimpose a system our Gosplan can easily construct and enforce. Enter the Lerner-Vickrey-Colander solution.

Say we wanted to control the prices of the health sector -- maybe keep 'em on track with the overall movement of the price level.

Simple: you cap the markup over non-sector inputs for all sector firms, by creating a sector-wide markup warrant market.

This essentially limits depreciation charges, wages, salaries, as well as profits -- i.e. the same value that is taxed by a value added tax. The two would work well together in a whole-system application of markup caps (MUC) if, say, the corporate income tax (CIT) was modified into a value added tax (VAT).

Prolly firms would get issued a flow of warrant "credits". If a firm wants to increase mark up above warranted levels, the firm has buy the warrants with cash on the warrant market.

All this formally parallels the carbon warrant notions, of course -- I hope without the wild croaks of dismay from the pwog pond.

By the way, you could use a Pigou tax here too -- that was also devised in the roaring 70's by Weintraub et al. I favor the cap and trade mechanism because it sets the inflation rate, leaving the markup cost to the vagaries of the market, whereas the Pigou tax sets the mark up cost, leaving the ultimate inflation rate uncertain.

Health care, of course, is quite a different application than carbon, where I reluctantly prefer the Pigou tax method.

Either approach would be a lot better than being bondservants of the anarchy of corporate-administered pricing -- especially as we face.up ahead, looming at us through the windshield, the dark side of price-expectational inertia -- DEFLATION!

As Paul K puts it:

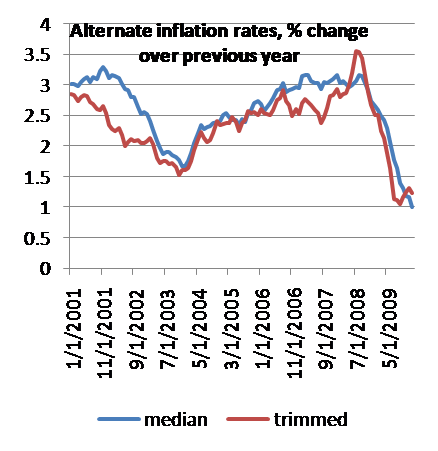

"what these measures show [i.e. various metrics of "core inflation"] is an ongoing process of disinflation that could, in not too long, turn into outright deflation"... and folks, we don't want to get into that tar pit.

Comments (7)

Couple of question-quiblbes.

The warrants system looks to be easy to game in the short run, thus allowing the defectors in essential industries to gain a position in which punishing them would necessarily also be a collective punishment.

Tracking the warrants looks to be a big full time job, with a perverse handicap. On the face, it looks very good for all concerned; less onerous than taxation and a balanced system would be flexible in ways that are out of reach for a tax code. I think the default assumption on the regulatory and consumer end would be an assumption of cooperation. But to be properly regulated, it would take consumer-driven control with real teeth, exercised in a way that's immediately responsive to shenanigans. Social ownership is great, but it's also ponderous.

Posted by Al Schumann | March 3, 2010 9:47 AM

Posted on March 3, 2010 09:47

al

the warrents are purchased post facto

ie after the purchases and sales

they are the "value added " in those sales

you can't store em up

they go on the market if you don't use whatever credits you qualify for

ie they are in essence tradeable tax credits

gaming recall is in the context of a jobbler class dictatorship

we welcome the gaming

all the better to show trial with

btw the project here prolly faces iterations

of itself to arrive at a durable system

will early versions look like that lapidary montage clip of early winged

heavier then air flight ??

yup

that's why i'd pilot the system on a choice sector or two first

btw

some clever slavic gosplan types

in the early 90's wanted to use this system

for the moment of marketization

obviously the kleptos and their MNC backers had better ideas eh ??

Posted by op | March 3, 2010 10:51 AM

Posted on March 3, 2010 10:51

marvelous passage in MAP blurb

i should have posted this up

it contains the delightful

abba neologism

realytic

"The methodology is realytic*...a contrast with analytic. .. we are primarily concerned with solving real problems... (MAP )also contributes ... to extending theoretical understanding, but... only where necessary to solve the problem at hand."

i like stressing this point

the model and the modeled need not be exactly parallel

if feed back exists eh ??

the mission is predicable controled price level change

something that amounts to a suicidal innovation

for private profit pooling free range MNCs

hence the power grab fantasy element

but as agit prop

map is great

it shows the present system

we joblings

tolerate

is quite transcendable

merely a historically evolved

system of institutional ways and means

a stage by stage

"phenotype by phenotype "

socially constructed instrumentality

posing as a providential secular rock of ages

Posted by op | March 3, 2010 11:07 AM

Posted on March 3, 2010 11:07

"Social ownership is great, but it's also ponderous"

the market mechanism at the core here i think adds mid range firm level

multiply and independently targeted

missions

i agree about ulitmo

household consumer -buyer sovereignty

the power to start a firm is very important

nothing here makes that monolithic

recall the dome credit model

with its mutually independent sources of credit

operated by personal gain motivated

but escrowed payouted

agents

with in essence all their bodies in the great game of venturing

not just their skin

Posted by op | March 3, 2010 11:13 AM

Posted on March 3, 2010 11:13

as usual i left a gaping hole

why would map make battling deflation easy ??

well today's controversy among those

big footers playing the role

of well intended whole people thinkers

rests on the inflation taboo

yes induced inflation is an obvious and easy cure for deflation

and yes

uncle produced inflation

would not exceed the technical methods availible to the fed

and those methods are well enough understood to be used immediately by our policy econ cons

but...

the only inflation worth inducing here

as many prudent chaps submit

ia a controled inflation

not some wild spiral like hit us in the roaring 70's

--when MAP was created--

we need a controled infdlation

for this

--as well as a multitude

of other macro tasks --

like controled fires or implosions

controled inflation

would be a dandy policy force

even now

but our present system has no institutionalized way

to control an inflation

once the fed starts one

enter MAP !!!!

Posted by op | March 3, 2010 11:26 AM

Posted on March 3, 2010 11:26

"consumer-driven control with real teeth, exercised in a way that's immediately responsive to shenanigans'

we have the experience of the ration system in the war years

as social data on mass enforcement

i haven't read the literature on this if it exists in any centralized and compact form

but some voice in my head sez i read somewhere

plain folks made good price hike vigilantes

once "the system" encouraged citizen reporters

Posted by op | March 3, 2010 11:30 AM

Posted on March 3, 2010 11:30

as to the shadow like prices of intermediate products

well there like always

the colusion must be fought ultimately by releasing competitors into the markets

and keeping the market structures operating

"as if " perfectly competitive

the beauty of the best

of the neo classical results

they show use where cleo will eventually use us to go

the real rational ??

i say yes

correctly defined

ie

a collective rationality

that in each agent is incomplete and

inconsistent and is globally driven on

by it's incompletenes and inconsistencies :

a "self rationalizing "

deep structure

that is an historical product

a deep structure

that re4veals itself to itself

always massively infested with new

transient forms of irrationality

of course these marvelous iraationalities

as dosty noticed are the unknowing termites

of the next "higher deep structure rationality "

of course dosty saw it as holy mother russia

but that's close enough for this kind of

prophetic big picture work

Posted by op | March 3, 2010 11:42 AM

Posted on March 3, 2010 11:42