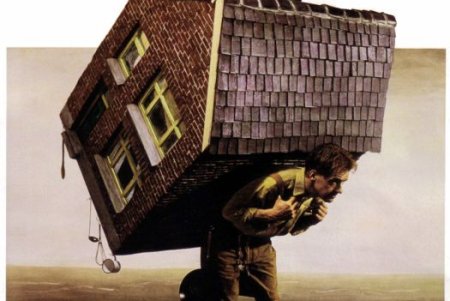

Bail, damn you, bail

http://www.washingtonpost.com/wp-dyn/content/article/2007/04/18/AR2007041802499.html?referrer=email Maybe some sub-primers will get the relief we called for here, though so far it looks to have the usual big bold talk and small penis one associates with these two waddling behemoths. Their function, after all, is to turn lending to us homemakers into a barrel shoot for "the private lending interests".

If it's for real, and gets really rolling, this bailout, by my seat of the pants guess, for the whole subprime quagmire, could end up needing about 20 times as much as the two Uncle-spawned and -backed outfits are dummying up here (ie 500 billion maybe 750 billion in Uncle guarantees.)

Most importantly, imo, there's a back story here, of course, provided for us by the wishywashy express, and it sure does seem to be aswim with the usual beltway smelly factoids.

My favorite: the fiercely snarling false teeth of our ever heroic tribunes, the donk house boyz, as they pressure "both companies [Fannie Mae and Freddie Mac] ... to demonstrate that they perform a public service." Demonstrate to who? Rep. Barney Frank, that's who, the man from Newton Lower Falls himself, who according to this article is making large motions about requiring uncle's two spoiled brats "...to contribute to an affordable housing fund," 'cause battlin' Barney feels "the public has not received enough value in return for the commercial advantages Fannie Mae and Freddie Mac get from their government ties."

"The public?" Hmmmmmm. Poke around in this soup a bit, and I bet there's a private label under the cover of all this "the public" business.

Note well: we often hear this stuff called a cheap Wall Street bailout, when its some sub-saharan state that's on the dunking stool.

Recall, fellow citizens: if Uncle saves an 'umble 'omeownin' defaulter, He saves the stiff's generous soft hearted creditor's arse too, don't he now?