In July, the Riksbank fixed interest rates at minus 0.25 percent on certain deposits kept by the commercial banks at the central bank.With the negative rate, banks are effectively fined if they hoard unused funds in the central bank's coffers -- a way of punishing them for a conservative lending policy at a time when the authorities want to ensure the economy gets easy credit.

Banks are usually paid interest on these deposits.

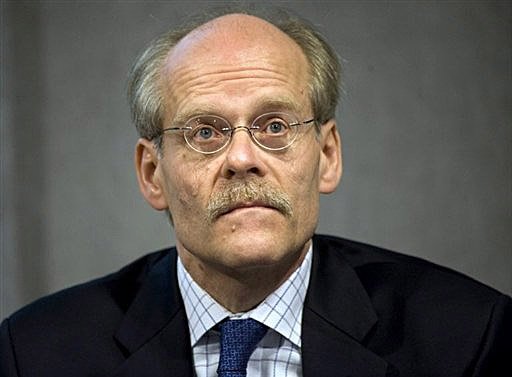

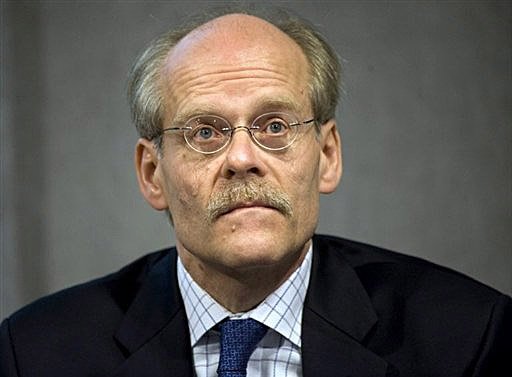

"It's better for a bank to be active... (rather) than just sit on the money," Riksbank governor Stefan Ingves told AFP.

In honor of Labor Day, I recommend a penalty rate of at least negative 10%. Market forces, my friends, would take care of the rest.

Demurrage has a noble function. Not least in the creation of incentives for long term, labor intensive, fixed capital investments. And when the idiot rich start hoarding and imposing punitive scarcity, a negative interest rate gives them a much needed fillip.

Owen raises an important issue:

stefy has henry fonda eyes now don't hethat prim startled look

of ferocious anality

For comparison, Mr. Henry Fonda.

The side by side, to assist clarity.

What do you think?

Comments (10)

" in July, the Riksbank fixed interest rates at minus 0.25 percent on certain deposits kept by the commercial banks at the central bank."

a major road mark

on to a fully indexed national balance sheet

capital taxes and interest and ground rent taxes used in one unified algorithm

dynamic as satans jitter bug

Posted by op | September 8, 2009 10:59 AM

Posted on September 8, 2009 10:59

I do love me some capital mobility. What with idle capital accumulations being the tools for Satan and all, it's reasonable to call demurrage and capital taxes and interest and ground rent taxes the Lord's smiling solution.

Posted by Al Schumann | September 8, 2009 3:46 PM

Posted on September 8, 2009 15:46

indexed ???

--in fact of course two way indexed

( to be strictly class neutral) up and down

no zero floors here either --

but indexed to what citizen paine???

to the ratio of change in average value added per hour and average hourly wage

get my gimmick fellow pink panty types ??

so how would it work exactly ??

very very intricately

Posted by op | September 8, 2009 4:35 PM

Posted on September 8, 2009 16:35

the mission ?

capture the free corporate surplus ggenerated

by job market rent sump

bare necessities

think efficency wage

Posted by op | September 8, 2009 4:38 PM

Posted on September 8, 2009 16:38

the exploiter max is still incentivized

---hoorah for gains from enterprise eh ??---

while the rentier class distributes

evenly amongst themselves

the total socialization off set

uncle sam aka "hammer of the rentiers"

hizseff extracts

thru interest rate like

confiscatory tax blow backs

wagery gets it back as public goods

see

something even for the nanny state goo goos

Posted by op | September 8, 2009 4:45 PM

Posted on September 8, 2009 16:45

the only meaningful social science

is mad social science

Posted by op | September 8, 2009 4:46 PM

Posted on September 8, 2009 16:46

my verge of sleep

clithonic love demon

lady maggie thatcher

http://coromandal.files.wordpress.com/2009/07/margaret-thatcher.jpg

in her living flesh years

liked to talk about "honest money"

ahh i can see her saying now

oh that glare of superiority!!!

well here's a way to keep money honest

and still clip the wealth coupon to society wide specifications

Posted by op | September 8, 2009 4:56 PM

Posted on September 8, 2009 16:56

jobs and joy thru usury update :

http://www.msnbc.msn.com/id/32737999/ns/business-stocks_and_economy/

"The Federal Reserve reported Tuesday that consumers in July ratcheted back their credit by a larger-than-anticipated $21.6 billion from June, the most on records dating to 1943. Economists had expected credit to drop by $4 billion.

July’s retreat translated into an annualized decline of 10.4 percent. That followed a cut of $15.5 billion in June, or a 7.4 percent annualized drop, and was the most since a 16.3 percent decline in June 1975.

The latest cut still left total consumer credit at $2.47 trillion.

Wary consumers and hard-to-get credit both factor into the scaled-back borrowing. But economists are split on which force — lack of demand by consumers or lack of supply from banks — is having the bigger influence.

“It’s really a tug of war,” said Mark Williams, professor of finance and economics at Boston University and a former Fed bank examiner. “It’s true that consumers are being more responsible, saying ’I don’t really need that extra credit card,’ but it is more related to banks clamping down on lending.” "

"a report earlier this year by the company that produces the most widely known credit scores found that companies slashed limits for an estimated 58 million card holders in the 12 months ended in April, even though a high percentage had good credit scores when their limits were cut

“As great as the clunkers program has been, it’s tough to head out and buy a big ticket item when you don’t have a job,” "

Posted by op | September 9, 2009 5:33 AM

Posted on September 9, 2009 05:33

stefy has henry fonda eyes now don't he

that prim startled look

of ferocious anality

Posted by op | September 9, 2009 12:23 PM

Posted on September 9, 2009 12:23

Hmmm -.25%,...

I've been dreaming of this, it's the first sign ... soon it'll be Two men enter One man leaves.

Posted by Son of Uncle Sam | September 9, 2009 2:07 PM

Posted on September 9, 2009 14:07