Gnome: US needs IMF treatment

http://www.theatlantic.com/doc/200905/imf-advice/4

"Oversize institutions disproportionately influence public policy; the major banks we have today draw much of their power from being too big to fail.Sound promising? Yeah baby yeah! It continues:Nationalization and re-privatization would not change that; while the replacement of the bank executives who got us into this crisis would be just and sensible, ultimately, the swapping-out of one set of powerful managers for another would change only the names of the oligarchs."

"Ideally, big banks should be sold in medium-size pieces, divided regionally or by type of business. Where this proves impractical—since we’ll want to sell the banks quickly—they could be sold whole, but with the requirement of being broken up within a short time. Banks that remain in private hands should also be subject to size limitations."Still hot to trot? That's simple Simon Johnson, former head green eye shade agent of the IMF.

I bet you still like his reasoning. Read on:

"This may seem like a crude and arbitrary step, but it is the best way to limit the power of individual institutions in a sector that is essential to the economy as a whole. Of course, some people will complain about the “efficiency costs” of a more fragmented banking system, and these costs are real. But so are the costs when a bank that is too big to fail—a financial weapon of mass self-destruction—explodes. Anything that is too big to fail is too big to exist."(Here's the goofball drop)"To ensure systematic bank breakup, and to prevent the eventual reemergence of dangerous behemoths, we also need to overhaul our antitrust legislation...."

"... Laws put in place more than 100 years ago to combat industrial monopolies were not designed to address the problem we now face. The problem in the financial sector today is not that a given firm might have enough market share to influence prices; it is that one firm or a small set of interconnected firms, by failing, can bring down the economy."Simple question: so a thousand dominoes, all able to fall into each other in sequence, won't all drop just because they're independently owned? Horse apples.

The Wall Street credit system went into crisis, not because it was an unaccountable bunch of giant octopi, but because the system's basic operating units -- as big as they seem to the naked pleb eye -- are in fact too small, too private, and too self-dependent.

The truly sublating re-structuring -- which we won't see of course -- is one big national credit/payments grid, hooked directly into Uncle's dollar mine, and all strung deftly together with a wickedly flexible set of credit lines and tripwires, geared and regulated by interest and principal payments, replete with default and delinquency premiums, principal balance adjustments, etc., all based on an indexed state of the economy morph-mode algorithm designed to... blah blah blah. As our last Spartan, Mike Dawson might say, 'just a lot o' practically simple but politically impossible stuff.'

Listen up, all you red plebs, with yer oh so so kool small local and green is beautiful fools' macarena -- this isn't our great great great grand daddy Andy J's America we got convulsing out there on us. Today we got both the tools and the tech to climb right out of this national seizure, and into a public credit system with loan agents that don't need to be shot on sight by honest toilin' folks.

One grid, many contending nodes.

Agency issues? Dealt with through shrewd compensation packages.

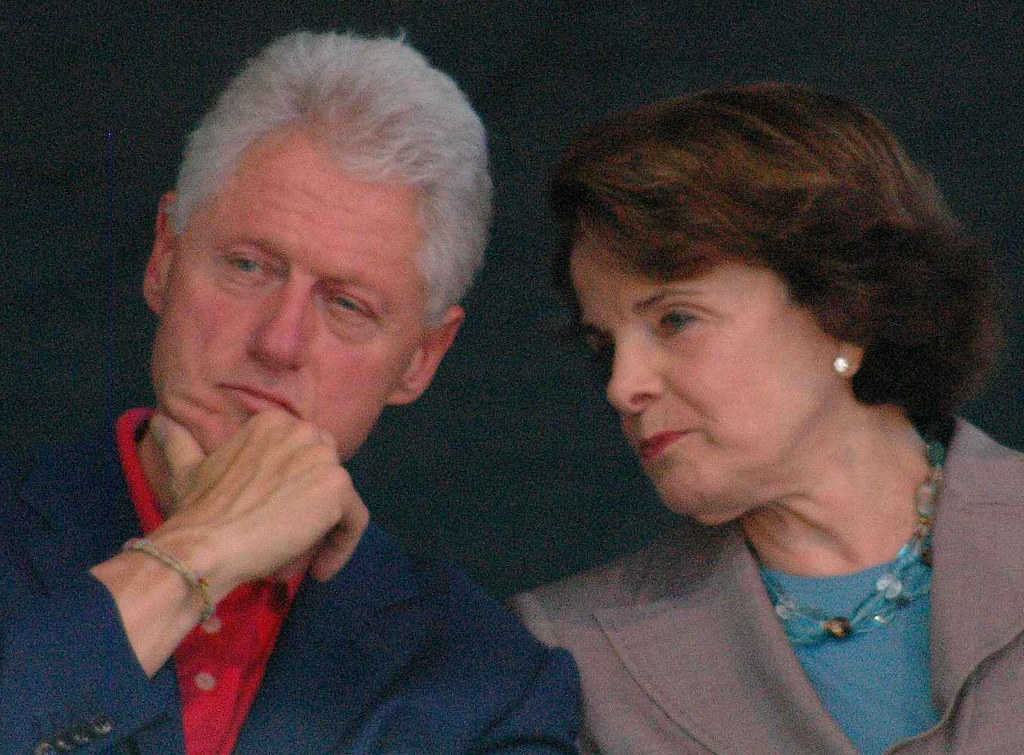

The Democrats were all strongly behind EFCA as long as it had no chance of passing. But now that they have a majority in both houses, they must find a face-saving way to lose the fight (except Dianne Feinstein -- shown left, with another fox in the hencoop -- who apparently needs no excuse and has thrown EFCA overboard with a shameless barefaced fuck-you grin.)

The Democrats were all strongly behind EFCA as long as it had no chance of passing. But now that they have a majority in both houses, they must find a face-saving way to lose the fight (except Dianne Feinstein -- shown left, with another fox in the hencoop -- who apparently needs no excuse and has thrown EFCA overboard with a shameless barefaced fuck-you grin.)

What are you thinking of, you poor benighted little people?

What are you thinking of, you poor benighted little people?

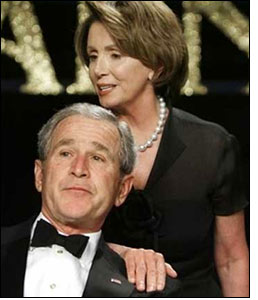

The face of American fascism?

The face of American fascism?

(That's the infamous Dick Holbrooke, world traveller to the world's sorrow, shown

above.)

(That's the infamous Dick Holbrooke, world traveller to the world's sorrow, shown

above.)