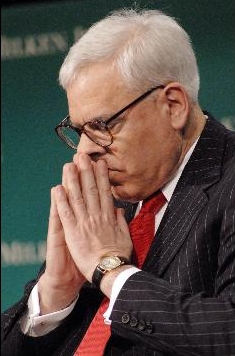

This is the face of the credit crisis in action: David M. Rubenstein co-founder of The Carlyle Group, private equity personified and prolly still making it at both ends.

http://www.bigthink.com/user/david-rubenstein

Well, read here how he's dumping his stale leverage play on mortgaged-backed securities. The downward cascade proceeds apace. Basics of all these fandangos:

"The fund was set up in August 2006 with roughly $670 million in cash from Carlyle's owners and other investors, and about $300 million in additional capital raised from a public stock sale. The capital allowed the fund to go to banks and borrow far more, leveraging its cash investment some 20 times into the portfolio."I.e., they bought $20 billion in securities, with only one bil of their own money in the pot. Now comes the drop and the margin call:

"As the market value of the Fannie Mae and Freddie Mac securities has dropped, Carlyle Capital's lenders asked it to increase its cash equity from what was 1 percent to as much as 5 percent"Their answer:

"In a statement, Carlyle Capital said that it had been unable to meet margin calls in excess of $400 million over the past week and that it expected its lenders to take control of its remaining assets."Now for the dump, aka "let's all join the cascade":

"The lenders, headed by Deutsche Bank and J.P. Morgan Chase, began selling the securities last night..."

Comments (3)

Selling them to whom? . . . Never mind, I already know the answer to that.

Posted by Fledermaus | March 13, 2008 7:11 PM

Posted on March 13, 2008 19:11

on a lesser note

consider the link

a carnal metaphor

for the high god of capitalism

sort of like a foundering bovine

iz a market jesus

http://hosted.ap.org/dynamic/stories/C/CONGRESS_SLAUGHTERHOUSE_ABUSE?SITE=AP&SECTION=HOME&TEMPLATE=DEFAULT

Posted by op | March 13, 2008 7:23 PM

Posted on March 13, 2008 19:23

amen

to the mendell tendency

Posted by op | March 13, 2008 7:25 PM

Posted on March 13, 2008 19:25